Accounts Payable (AP) is a crucial aspect of financial management for any organization. It is the process of managing and paying the bills, invoices, and expenses incurred by a business. An automated accounts payable system can improve cash flow, reduce the risk of late payment penalties, and increase operational efficiency. In this blog, we will take a deep dive into the accounts payable process, its components, and the benefits of accounts payable automation.

What is an Accounts Payable Process?

The accounts payable process refers to the series of steps involved in paying bills, invoices, and expenses incurred by a business. It starts with the receipt of a vendor invoice and ends with the payment of the invoice. The process includes several key stages, including purchase orders, vendor invoices, receiving reports, three-way matching, review and approval, and payment processing.

What Does Accounts Payable Include?

1. Purchase Orders

A purchase order (PO) is a document that outlines the details of a purchase made by a business. It includes the type and quantity of goods or services to be purchased, the agreed-upon price, and the payment terms. POs solutions are important because they help ensure that the right goods or services are received at the right price.

2. Vendor Invoices

A vendor invoice is a document that a supplier sends to a business to request payment for goods or services provided. It includes the details of the goods or services provided, the amount due, and the payment terms. Vendor invoices are important because they provide a record of the transactions between a business and its suppliers.

3. Receiving Reports

A receiving report is a document that confirms the delivery of goods or services. It includes the details of the goods or services received, the quantities, and the conditions. Receiving reports are important because they help ensure that the goods or services received match the specifications outlined in the purchase order.

4. Three-Way Matching

Three-way matching is a process that ensures that the purchase order, vendor invoice, and receiving report all match. This process helps to prevent errors and ensure that the right goods or services are being paid for. If there are any discrepancies, they can be addressed before payment is made.

Review and Approval:

Once the three-way matching is complete, the vendor invoice is reviewed and approved for payment. This step involves checking the accuracy of the invoice, verifying that the goods or services have been received, and ensuring that the invoice is in compliance with the company’s policies and procedures.

Check Out Our Blog- Modernize Your Accounts Payable Process in 2023

5. Payment Processing

Once the vendor invoice has been approved, it is processed for payment. This step involves generating a payment file, printing checks, or initiating an electronic payment. The payment is then sent to the supplier, and the accounts payable process is complete.

Download Our Whitepaper- The C-Suite’s Guide to Successful Accounts Payable Transformation

What is Accounts Payable Automation?

Accounts payable (AP) automation is the use of technology to streamline and simplify the accounts payable process. Instead of relying on manual processes such as paper invoices, manual data entry, and physical approvals, companies can use automation tools to digitize and automate many of these tasks. AP automation can include features such as electronic invoicing, automatic data capture, and automated workflows for invoice approvals and payments. By automating these tasks, companies can significantly reduce the time, effort, and resources required to manage their AP processes.

Why should organizations move to automated accounts payable system?

There are several compelling reasons why organizations should consider moving towards AP automation. Firstly, automation can help reduce errors and inaccuracies in the AP process. Manual data entry can often lead to mistakes, which can cause payment delays and disputes with vendors. With automation, data can be captured and transferred electronically, reducing the risk of human error. Additionally, automation can help improve compliance and audit readiness, as automated systems can provide an auditable trail of all transactions.

Another advantage of AP automation is that it can help organizations save time and money. Automation can reduce the time spent on manual tasks such as data entry, invoice matching, and approvals, freeing up staff time for more strategic activities. This can help organizations operate more efficiently and effectively, enabling them to focus on their core business activities. Additionally, AP automation can help companies save money by reducing processing costs and avoiding late payment fees or duplicate payments. With these benefits, it’s no surprise that more and more companies are starting to adopt AP automation as part of their overall digital transformation efforts.

Download Report – Discover a 6-step winning strategy for developing a AP Automation business case

The Challenges in Accounts Payable

Accounts payable automation offers numerous advantages, but it also presents several challenges that businesses must navigate carefully to realize its full potential:

- Manual Processes and Slow Payment Cycles: The reliance on manual processes can lead to slow processing times as documents are shuffled between departments. This not only delays payments but can also impact company cash flows and relationships with suppliers due to missed discounts and incurred late fees.

- Error-Prone Data Entry: Manual data entry is susceptible to errors, which can result in payment inaccuracies such as overpayments or duplicate payments. These errors are often time-consuming to rectify and can lead to significant financial losses.

- Fraud Risks: Manual and disjointed systems increase the vulnerability to both internal and external fraud. Without robust controls and oversight, fraudulent activities such as duplicate invoicing and unauthorized purchases can go undetected, leading to financial losses.

- Complex Vendor Management: Managing multiple vendor relationships and payment terms can be challenging, particularly when dealing with a variety of payment methods and compliance requirements. This complexity can lead to mismanagement and inefficiencies unless properly handled with automation tools.

- Regulatory Compliance and Audit Readiness: Ensuring compliance with regulatory standards and maintaining readiness for audits can be difficult when using manual or outdated processes. Automation helps in maintaining accurate records and streamlining compliance processes.

Read more: Accounts Payable Challenge & How to Solve Them

By addressing these challenges through the strategic implementation of accounts payable automation solutions, businesses can enhance efficiency, reduce errors, and improve vendor relationships and compliance. These improvements are crucial for maintaining a healthy cash flow and a robust financial operation.

Benefits of Accounts Payable Automation:

1. Improved Accuracy and Efficiency:

Automating the accounts payable process can help reduce errors and improve accuracy. Automated systems can automatically match invoices to purchase orders and receiving reports, reducing the risk of human error. This can lead to faster processing times, increased efficiency, and improved cash flow.

Read Our Blog- Gaining Actionable Insights with Zycus Accounts Payable (AP) ROI Calculator

2. Better Visibility and Control:

Automated accounts payable system provide real-time visibility into the status of invoices and payments. This allows businesses to have better control over their cash flow and make informed decisions about their finances.

3. Enhanced Compliance:

Automated accounts payable system can help ensure compliance with regulations and company policies. Automated systems can enforce approval workflows and ensure that invoices

The greatest benefit of automation is efficiency—it frees up valuable time for AP teams who would otherwise be bogged down in tedious manual tasks. In our customer value studies, AP teams are able to save 40-60% of their time across various repetitive and manual activities. This time can be employed to do more strategic work.

Source: IOFM 2022 Accounts payable benchmarking survey

Looking at PO invoices paid on time as a function of invoice volume with respect to the IOFM data , we see that larger organizations are able to do this all the time, and more often than their smaller counterparts. However, smaller organizations do somewhat better if you look at the aggregated data for those who pay on time with 90% or higher frequency.

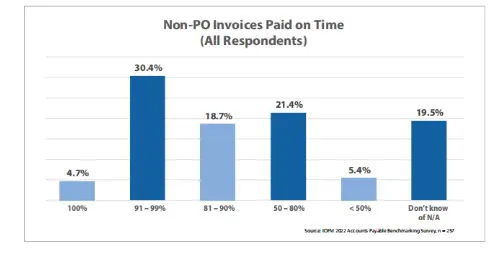

Source: IOFM 2022 Accounts payable benchmarking survey

When the payment promptness for non-PO invoices is correlated with invoice volume, we see that this poses the greatest challenge for organizations dealing with high volume of invoices. This is likely because these invoices require research to determine approvers and get their sign-off, which may be more difficult in large organizations.

Automation reduces human error, which can be a major issue when dealing with high volumes of invoices or complex data sets. Finally, automation ensures consistency in an otherwise chaotic environment; every invoice gets processed exactly the same way, every single time, thereby eliminating any potential discrepancies between invoices.

To know more on how AP automation can be a business driver for your organization, read: How organizations can use AP Automation as a strategic business driver.

Cutting-Edge Technologies Transforming Accounts Payable Automation

The landscape of accounts payable (AP) automation is powered by a variety of advanced technologies that streamline and enhance the efficiency of financial operations:

- Optical Character Recognition (OCR): OCR technology is fundamental in AP automation. It enables the scanning and digital conversion of paper invoices into editable and searchable data. This technology minimizes manual data entry errors and speeds up the processing time by extracting critical information from invoices quickly and accurately.

- Artificial Intelligence (AI) and Machine Learning (ML): AI and ML are at the core of modern AP systems, providing capabilities such as predictive analytics for cash flow management and intelligent data capture that improves over time through learning algorithms. These technologies help in identifying patterns, predicting future outcomes, and automating routine tasks, which significantly reduces processing times and enhances decision-making.

Read more: Unleashing Generative AI in Accounts Payable - Robotic Process Automation (RPA): RPA uses bots to automate repetitive tasks that were previously done manually, such as data entry, invoice matching, and transaction processing. This not only speeds up operations but also reduces the potential for human error and allows AP staff to focus on more strategic tasks.

- Blockchain Technology: Increasingly, blockchain is being explored for its potential to secure transactions and enhance transparency in the AP process. By providing a decentralized and tamper-proof ledger, blockchain can facilitate faster approvals and payments, and reduce fraud risks.

- Integration Capabilities: Modern AP automation solutions are designed to integrate seamlessly with existing enterprise resource planning (ERP) systems and financial software. This integration allows for a unified view of financial data, streamlined workflows, and improved accuracy and compliance in financial reporting.

These technologies collectively enhance the strategic impact of accounts payable departments, turning them into valuable hubs for financial optimization and strategic business insights.

The AP Automation Tool for Businesses: Zycus AP Smart Desk and its impact

The AP Smart Desk automates the entire invoice cycle from start to finish. It begins by automatically extracting data from invoices sent via emails. This eliminates manual data entry and OCR issues while also reducing errors in the process. Once the data has been extracted, it can be automatically matched against Purchase Orders (PO) or contracts—eliminating manual matching processes that are often tedious and time consuming. Where escalations or manual interventions are required, the Smart Desk allows the AP executive to override the tool or send the invoice for escalation approvals.

In addition to eliminating manual processes, the Merlin AP Smart Desk also provides visibility into maverick spend and compliance by providing payment terms guidance based on contracts or PO commitments. This is especially beneficial for businesses that have a decentralized purchasing process as it gives AP teams full visibility into their spending patterns.

To know more on this topic, read the blog on what is next in Accounts payable automation and its trends. For a free demo of Zycus AP smart desk, register now.

Related Read:

- Measuring Your Accounts Payable Operational Metrics Effectively

- Transforming AP: Collaboration Connects Accounts Payable to Strategic Business Processes

- Accounts Payable – Central to Strategic Financial Reporting

- Accounts Payable – A Strategic Business Value Driver

- How to Increase Accounts Payable productivity Without Increasing Headcount

- White Paper – Account Payables Report Card: Survey Findings

- Blog – Why the Accounts Payable Turnover Ratio Matters for Your Business

- Blog- Setting Up Internal Controls in Accounts Payable Processes

- Press release – Zycus teams up with Ardent Partners to discuss the latest happenings in the Accounts Payable world